A Guide to Going Solar with Indiana Michigan Power (AEP)

Indiana Michigan Power (AEP)

Find out how much it costs for AEP customers to install solar panels

Understanding Indiana Michigan Power (AEP)

Indiana Michigan Power (AEP or I&M)

Utility Type: Investor Owned Utility (IOU). An IOU is a private, for-profit company that generates, transmits, and distributes electricity to customers in a designated service territory.

Headquarters: Fort Wayne, Indiana

Parent Organization: AEP

Website: www.IndianaMichiganPower.com

Contact for Solar Related Questions: DGCoordinator_IM@aep.com / 206.408.3402

Key takeaways for switching to solar with AEP

Solar Policies: As an IOU, AEP’s solar policies are regulated by the Indiana Utility Regulatory Commission (IURC).

Commonly Used Solar Programs:

Excess Distributed Generation Tariff - This program provides a credit to your utility bill in the amount of 125% of the “market price” (not the retail price!) for power for all excess energy generated.

Current Market Price or bill credit: $0.0361 per kwh

Go-Off Grid - Disconnect from NIPSCO or install a system separate from the grid. Click here.

Get a free and unbiased estimate from an Indiana solar designer on how these programs may benefit you.

Go Solar with AEP >>

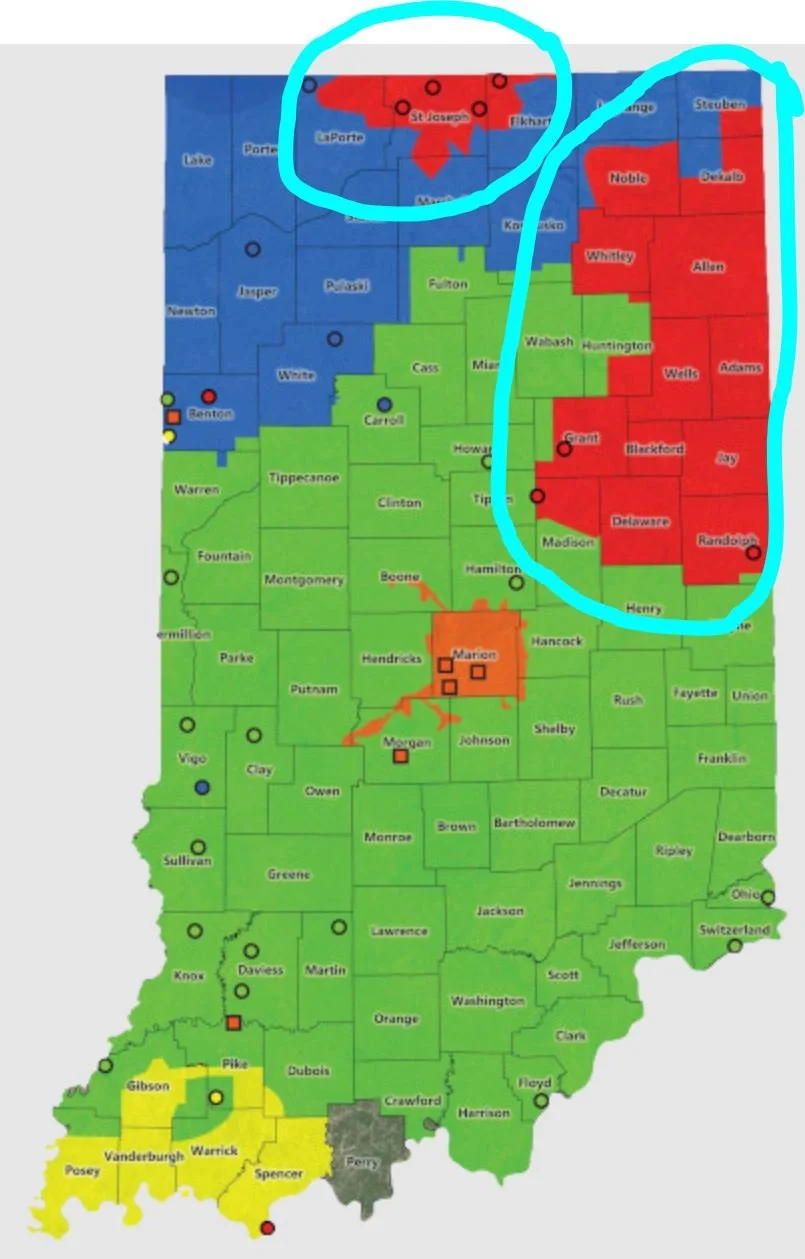

AEP Indiana Service Territory

“For solar owners, AEP offers the Excess Distributed Generation Tariff (EDG).

EDG allows you to use your solar energy (which you get the full value out of), and the credits are $0.0361/kwh for excess generation.

EDG credit balances are not transferable to another service or account.

”

Want more tips ?

Download the Indiana Solar Guide

Top 10 tips on how to shop for solar in Indiana

Solar pitfalls and how to avoid them

Trusted advice from solar industry professionals

<< Download Now

See other AEP customers that switched to solar.

Are solar panels worth it for AEP Indiana customers?

Yes! For AEP customers in Indiana, adding solar panels can be a worthwhile consideration. Their Excess Distributed Generation Tarriff is a good option as it does provide the customer with a credit for excess energy generated. This credit is lower than the “retail rate” so you might consider adding battery storage or modifying the system size to maximize how much solar energy is consumed on site rather than sent back to AEP.

Additionally, the availability of the federal tax credit can offset the initial installation costs, making solar more accessible. Furthermore, with AEP's commitment to expanding its renewable energy portfolio, customers may benefit from a more favorable regulatory environment for solar energy adoption. However, individual circumstances, such as roof orientation, local regulations, and financial situation, should be evaluated to determine the overall value of a solar panel installation.